Back in 2012, I was getting emails from people asking where they could buy the New Rule concept ruler I had designed to help people with visual impairments. Enquirers wanted to buy them for their children to use in school and to help with exams when questions asked to measure an object on the exam paper in millimetres. I’ll be the first to admit that I have the business nouse of a dead mouse, so I contacted Ashley Sandeman, because he’s family, is very business minded (he’s written a book on it and has a rather interesting blog) and was thinking of starting up a new business. In the end we didn’t take the product to market, so I asked Ashley to write this article to explain why. I think this is an excellent example of how to determine the potential market size for a product you have designed before going to kickstarter etc. The design and enquiries happened before kickstarter was available in the UK, but there are valuable lessons here for anyone thinking of trying to take an idea to market with a loan, an angel investor, or through a crowd funding platform.

How you determine the “potential market size” when designing a product? A 5-step approach

Ashley Sandeman:

Step 1 – What do you honestly want?

It’s important before you start anything that you know what you want out of it and are honest with yourself.

I was looking for a business I could start, which would support me financially and allow me to launch other products leading to the full time employment of two people. For the sake of argument, let’s say I wanted a £50,000 turnover in the first year.

Knowing what I wanted and being clear about this lead to a series of questions:

- How big was the potential market for the product?

- What was the growth potential for the product into the foreseeable future?

- At what price could the product be sold or what price would it need to be sold and was this realistic?

- What are the costs of setup including a first production run? (I won’t be answering this here)

- What alternative products are available?

- What was the likely uptake of the product?

All of these questions are important to answer, but I chose to focus on the potential market size to quickly highlight any problems.

Step 2 – Determining the potential size of the current market

First the quick way - via a keyword search. I used this because search engine data is aggregated. I tried several terms, but as an example, I used the phrase “ruler for visually impaired.” You can use tools such as Market Samurai to interrogate this data using keywords that reveal daily broad matches, phrase matches, and exact matches (which are best) for your words. It will also reveal the amount of competition for those words and the number of pages referencing your words. The Market Samurai data revealed that not only were very few people searching for “ruler for visually impaired,” but (at the time of writing) only 9 pages globally used the same phrase. There’s nothing wrong with a micro-niche. There’s a lot wrong with a market that hardly exists.

Now the long route, finding data on market size. This route will help explain why you see the results from the keyword research. I Google searched visual impairment sites until I could find data on visual impairment in school children. Not only had the contacts Product Tank received from people referred to school children, but He and I also felt this was the best group to approach. When we considered professions that used measurement there was always a better/more accurate alternative to the product. For example, engineers use computer models, digital callipers etc.

From a 2008 NHS (National Health Service) paper I found, the majority of people registered visually impaired in the UK are over 65. Under 18s make up just 4% of the group. Assuming 5-17 year olds would really benefit from the product, of those registered approximately 30% have an additional disability be it physical (most common), mental illness, a learning disability, etc. Looking at the available research I had to assume from a risk perspective that those with an additional disability would never take up the product.

Admittedly the data was not perfect, but it gave me a UK market size of 4986 potential customers.

In short, the market was looking quite small. I quickly generated a table in Excel using the data I’d gathered. Even if I priced the product highly at £9.99 (a large sum for a ruler) I’d need 100% uptake of the market to get close to my target £50,000 of sales turnover (4986 people x £9.99 = £49,858).

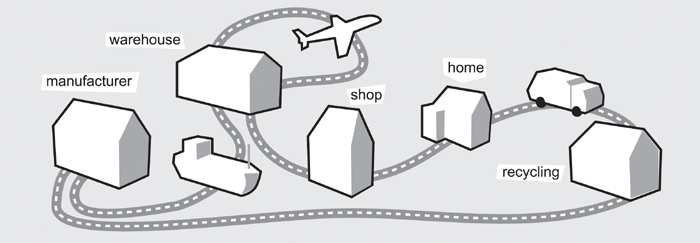

The figure of £49,858, minus expenses would be my profit and my expenses need to account for many things including tooling, manufacturing, CAD, prototyping, fulfilment, storage, accountancy, patents, licences, and wages factored into the process. In short, the UK market isn’t large enough to support the business - I needed a larger market.

So using the same techniques I then researched the US and found statistical information that indicated that just 1% of the US market is the same size as 77% of the UK market. I assumed a similar level of additional disability would occur in the US, but even so this gave a potential market of 383,000 people and I hadn’t yet considered Europe or Asia.

As you can see from my US Excel table, I only had to sell 11,495 units, just 3% of the market at $4.68 to get close to the same target I had in the UK. Looking purely at market size, things now looked more viable. The trouble is they weren’t.

I was beginning to determine the product’s price based on a figure I felt I needed to hit. Price should be based on the value you’re delivering, not on a figure you want to be paid. That I was leaning towards the latter was an early warning. I didn’t know the likely uptake of the product, but my search engine research (Market Samurai) had given me an indication. Despite the market size, people weren’t actively searching for the product in high numbers. Could it be that many didn’t feel it was a problem that needed solving?

Step 3 - Potential for Growth

As discussed, my research showed that new visual impairment cases make up a tiny percentage of the overall visual impairment figures. Age is a more likely determinant of poor visual health, and that wasn’t going to be my market. So after filling the market with a hopefully brilliant product on day one, once I’d reached a peak of initial uptake, the research showed that sales would be in decline from that point onwards. I know I’m making a lot of assumptions, but this is about getting a good feeling from a morning of research and making a decision to continue or not. The danger would be that I would always be running the risk of holding either more inventory than I could shift or running production so small I’d have to sell at too high a price.

There are a number of weaknesses with such a brief look at the market. Even people with good eyesight find reading a millimetre ruler difficult. Those children whose eyesight was fine, but who also found reading a millimetre ruler awkward may want to take up the product. There could be a larger market out there than I first thought. However, there’s a valuable business lesson here too: It’s easier to sell to an established crowded market than to a new market that doesn’t yet exist. Creating a new market is very expensive, and I felt at risk of doing that here. At least in a crowded market you know there are customers willing to part with their money. Could my market simply be anyone who needs to use a ruler, and my solution to supply them with the best ruler in that market? The answer here in my view is no. Rulers with large numbers are available. So are normal rulers and digital callipers. I’d be taking on the entire market with a product most consumers didn’t really need at a significant increase in price to a standard ruler (because of the extra parts), without the accuracy of a digital calliper.

Step 4 -, Understand your market, risks and competition

In understanding the UK and US markets my research showed that their education systems have different requirements. If you don’t understand your customer base you can’t help provide them with value. The first issue I faced was the metric system. In the UK we use centimetres and millimetres. In the US inches are a more common measurement. An inch is a larger measurement, creating a lesser visual impairment problem. It also creates a design problem as I can’t sell an identical product in both countries. This is before I even mention marketing and distributing in the US. The entire venture would require a lot of viral support from the visually impaired network as I couldn’t hope to cover the country.

Finally I examined the school system. Again if you Google something for long enough, or speak to the right people you’ll find your answer. Research can be a pain, but nothing compared to the pain of losing time and money. The UK school system did not penalise children for being unable to answer a measurement exam question, and such children could be provided with a modified exam paper if requested. The parents querying the availability through Product Tanks website might not be aware that their children didn’t need it for an exam, and so potentially are not customers. As for the rest of the world, as my keyword analysis revealed, people did not appear to find it a large enough problem to search for a solution.

Step 5 – Finally, (and most importantly) be honest

After all this I concluded that it was unlikely I would get a return on my investment of time and money. Helping the visually impaired is a great cause, and the knowledge that the product would be helping people was a clear motivator to bring it to market. But it would need to be approached from the perspective of philanthropy, not business. As hard as that sounds I think you need to be invested in this sort of market for the love of the product, and the risks of losing a lot of money was too great for me to adopt it for solely business reasons. If you’re going to live and breathe your business, you have to love it.

Ashley Sandeman is a business consultant and author of “101 Things I should have been taught at business school.” You can find his blog here

Sunday, June 30, 2013 at 04:57PM

Sunday, June 30, 2013 at 04:57PM

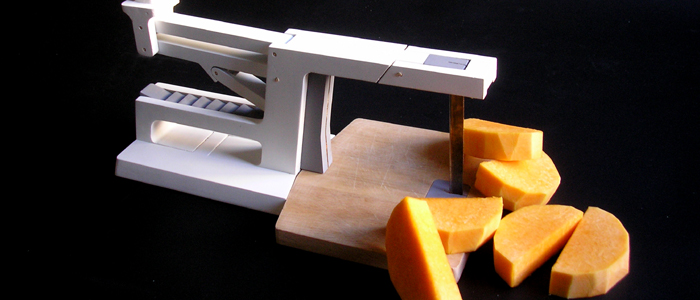

model making,

model making,  packaging,

packaging,  plastic in

plastic in  ideas,

ideas,  model making,

model making,  process

process